Business Insurance in and around Aurora

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

- Aurora, IL

- Batavia, IL

- Wheaton, IL

- Warrenville, IL

- Geneva, IL

- Naperville, IL

- West Chicago, IL

- Plainfield, IL

- Saint Charles, IL

- Winfield, IL

- Lisle, IL

- Bolingbrook, IL

- Woodridge, IL

- Carol Stream, IL

- Glen Ellyn, IL

- Downers Grove, IL

- Kane, IL

- DuPage, IL

- Cook, IL

- Will, IL

Cost Effective Insurance For Your Business.

Running a small business comes with a unique set of wins and losses. You shouldn't have to wrestle with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including worker's compensation for your employees, a surety or fidelity bond and errors and omissions liability, among others.

Looking for small business insurance coverage?

Almost 100 years of helping small businesses

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a barber shop, a veterinarian, or a dance school, having the right insurance for you is important. As a business owner, as well, State Farm agent Ryan VanderVeen understands and is happy to help with customizing your policy options to fit your business.

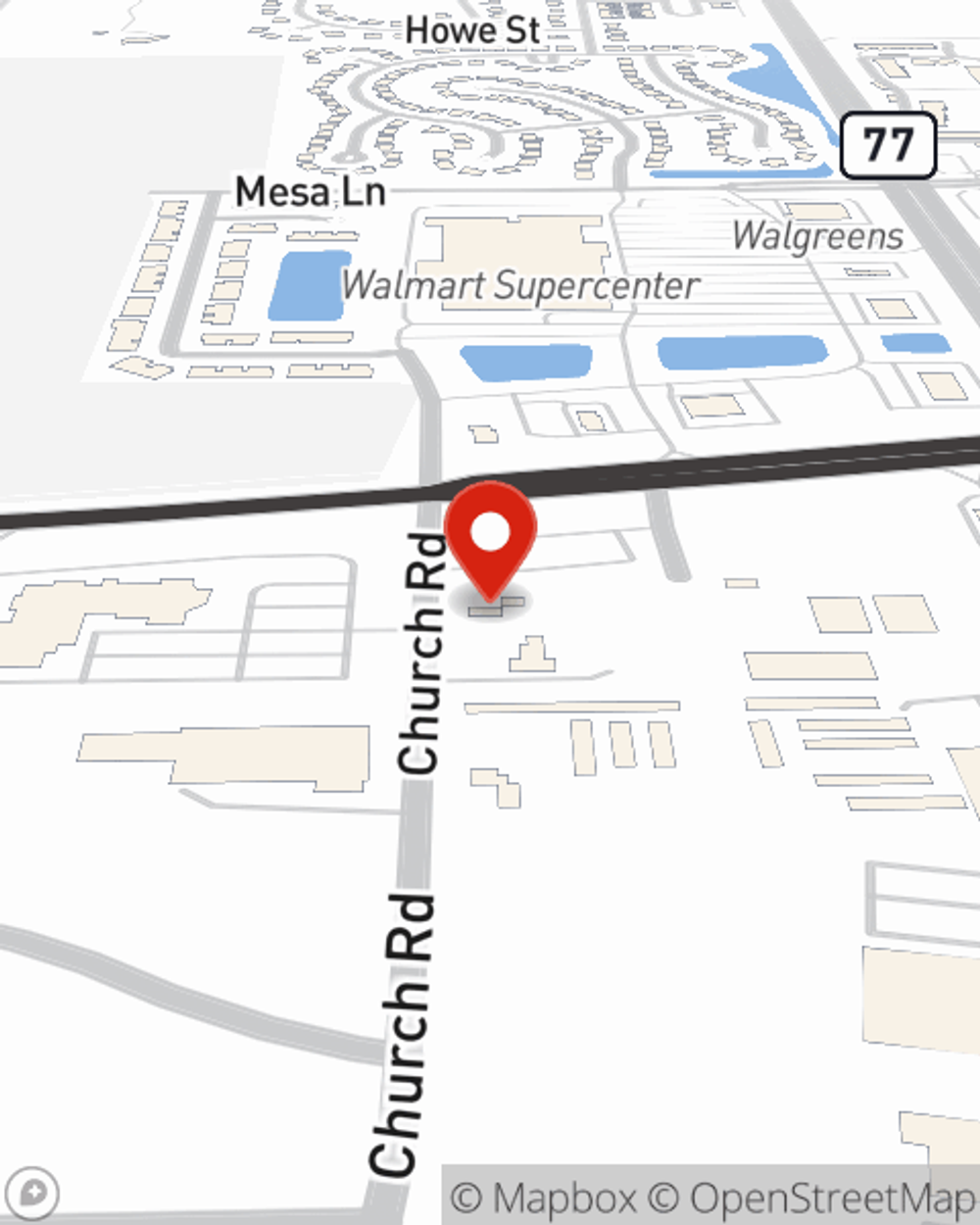

Ready to review the business insurance options that may be right for you? Stop by agent Ryan VanderVeen's office to get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Ryan VanderVeen

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.