Life Insurance in and around Aurora

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Aurora, IL

- Batavia, IL

- Wheaton, IL

- Warrenville, IL

- Geneva, IL

- Naperville, IL

- West Chicago, IL

- Plainfield, IL

- Saint Charles, IL

- Winfield, IL

- Lisle, IL

- Bolingbrook, IL

- Woodridge, IL

- Carol Stream, IL

- Glen Ellyn, IL

- Downers Grove, IL

- Kane, IL

- DuPage, IL

- Cook, IL

- Will, IL

Check Out Life Insurance Options With State Farm

No one likes to entertain ideas about death. But taking the time now to arrange a life insurance policy with State Farm is a way to show care to your partner if the worst happens.

State Farm can help insure you and your loved ones

Life won't wait. Neither should you.

Life Insurance Options To Fit Your Needs

The beneficiary designated in your Life insurance policy can help cover important living expenses for the people you're closest to when you pass away. The death benefit can help with things such as car payments, retirement contributions or house payments. With State Farm, you can rely on us to be there when it's needed most, while also providing sensitive, dependable service.

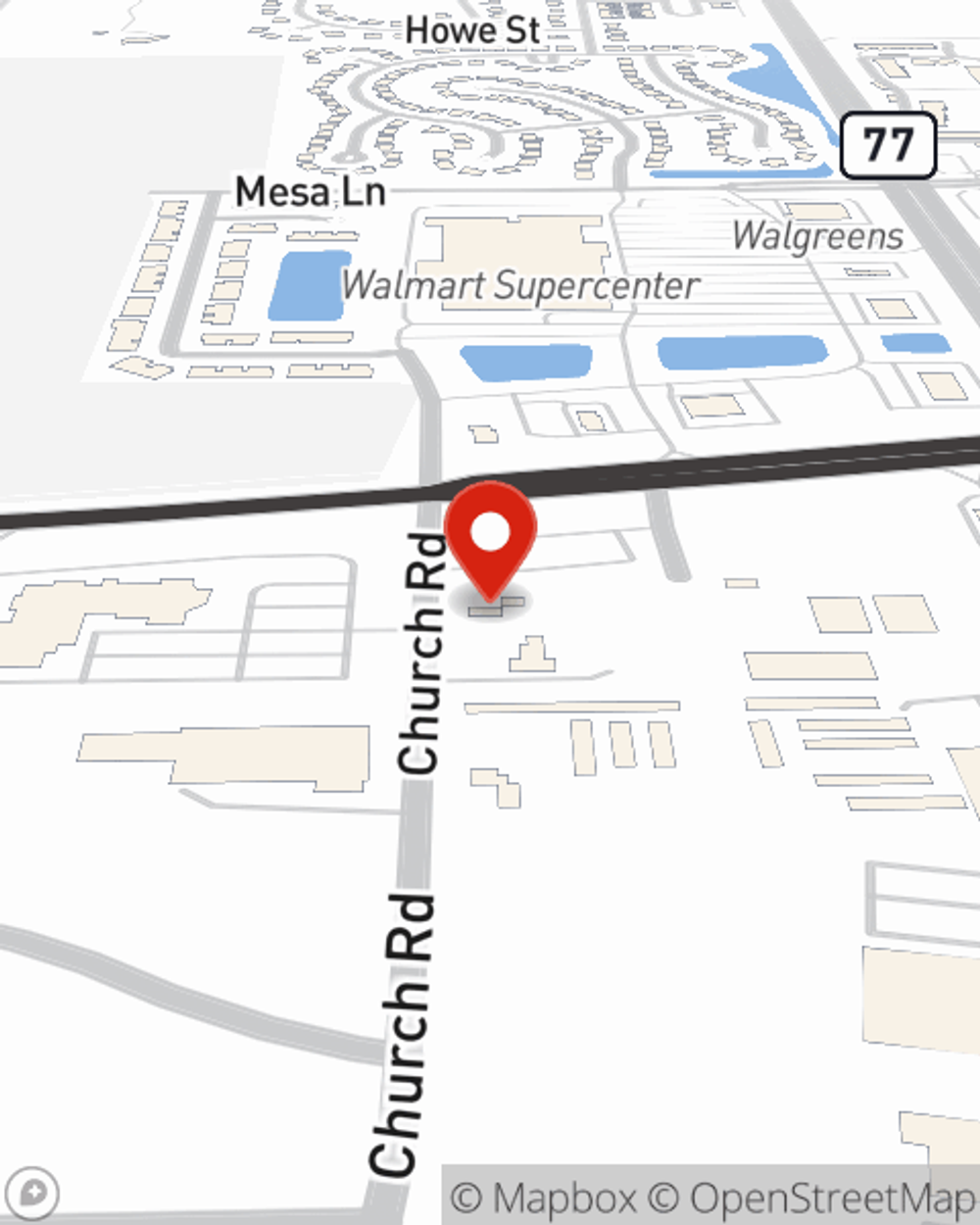

If you're looking for reliable coverage and responsible service, you're in the right place. Visit State Farm agent Ryan VanderVeen now to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Ryan at (630) 723-6994 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Ryan VanderVeen

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.