Homeowners Insurance in and around Aurora

If walls could talk, Aurora, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- Aurora, IL

- Batavia, IL

- Wheaton, IL

- Warrenville, IL

- Geneva, IL

- Naperville, IL

- West Chicago, IL

- Plainfield, IL

- Saint Charles, IL

- Winfield, IL

- Lisle, IL

- Bolingbrook, IL

- Woodridge, IL

- Carol Stream, IL

- Glen Ellyn, IL

- Downers Grove, IL

- Kane, IL

- DuPage, IL

- Cook, IL

- Will, IL

Welcome Home, With State Farm Insurance

Your house isn't a home unless you're protected with State Farm's homeowners insurance. This great, secure homeowners insurance will help you protect what you value most.

If walls could talk, Aurora, they would tell you to get State Farm's homeowners insurance.

Give your home an extra layer of protection with State Farm home insurance.

Open The Door To The Right Homeowners Insurance For You

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your most personal possessions safe. You’ll get a policy that’s personalized to correspond with your specific needs. Fortunately you won’t have to figure that out on your own. With empathy and excellent customer service, Agent Ryan VanderVeen can walk you through every step to set you up with a plan that shields your home and everything you’ve invested in.

Your home is the place where your loved ones gather, but unfortunately, the unpredictable circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Ryan VanderVeen can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Ryan at (630) 723-6994 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

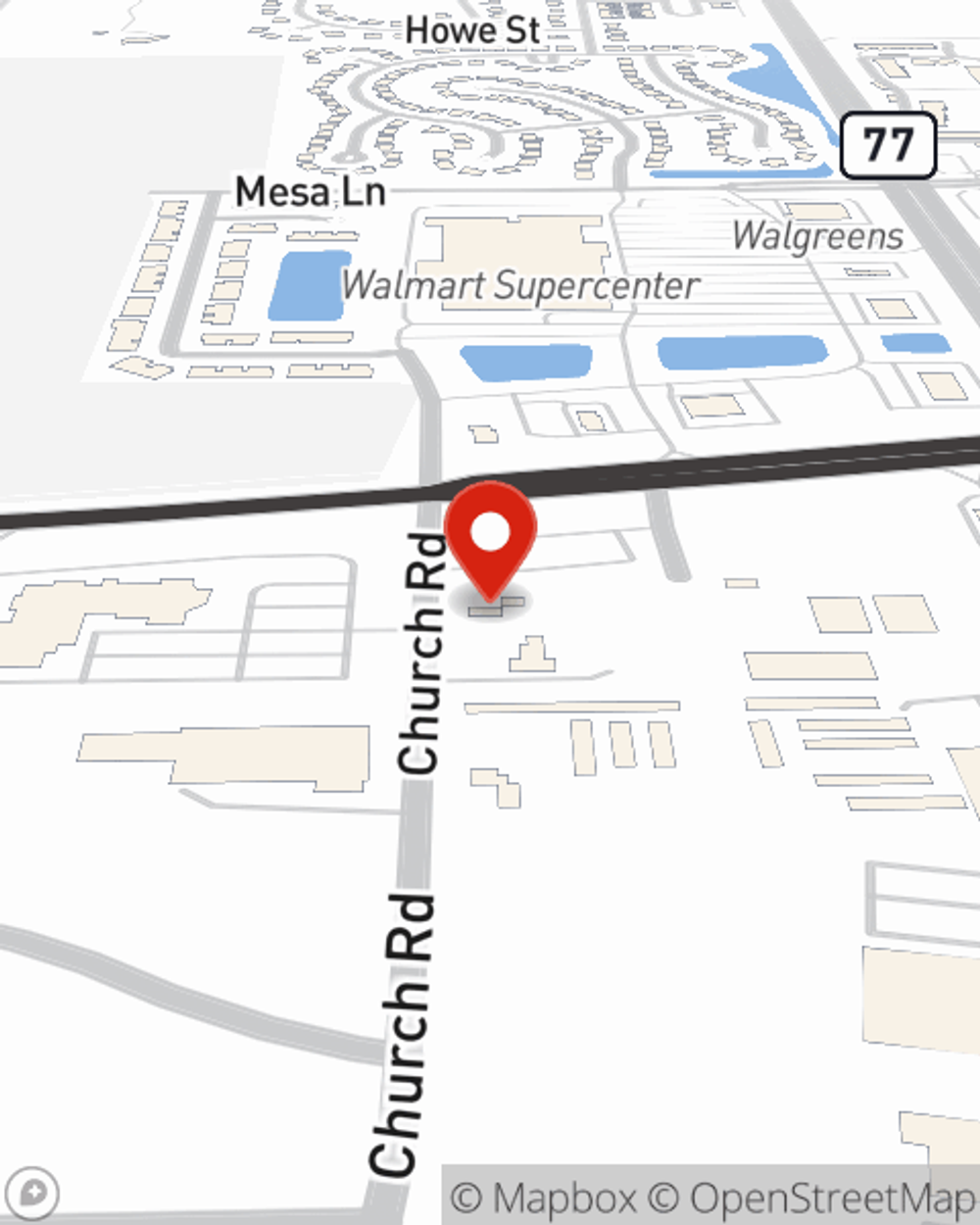

Ryan VanderVeen

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.