Renters Insurance in and around Aurora

Renters of Aurora, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Aurora, IL

- Batavia, IL

- Wheaton, IL

- Warrenville, IL

- Geneva, IL

- Naperville, IL

- West Chicago, IL

- Plainfield, IL

- Saint Charles, IL

- Winfield, IL

- Lisle, IL

- Bolingbrook, IL

- Woodridge, IL

- Carol Stream, IL

- Glen Ellyn, IL

- Downers Grove, IL

- Kane, IL

- DuPage, IL

- Cook, IL

- Will, IL

Home Sweet Home Starts With State Farm

Even when you rent a place to live you still have plenty of responsibility. You want to make sure what you own is protected in the event of some unexpected trouble or accident. And you also need liability protection for friends or visitors who might get hurt on your property. State Farm Agent Ryan VanderVeen is ready to help you handle the unexpected with reliable coverage for your renters insurance needs. Such considerate service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If mishaps occur, Ryan VanderVeen can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Renters of Aurora, State Farm can cover you

Renters insurance can help protect your belongings

Why Renters In Aurora Choose State Farm

When the unexpected abrupt water damage happens to your rented space or condo, usually it affects your personal belongings, such as a coffee maker, a bicycle or a video game system. That's where your renters insurance comes in. State Farm agent Ryan VanderVeen is dedicated to help you understand your coverage options so that you can protect your belongings.

Renters of Aurora, State Farm is here for all your insurance needs. Contact agent Ryan VanderVeen's office to get started on choosing the right policy for your rented apartment.

Have More Questions About Renters Insurance?

Call Ryan at (630) 723-6994 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

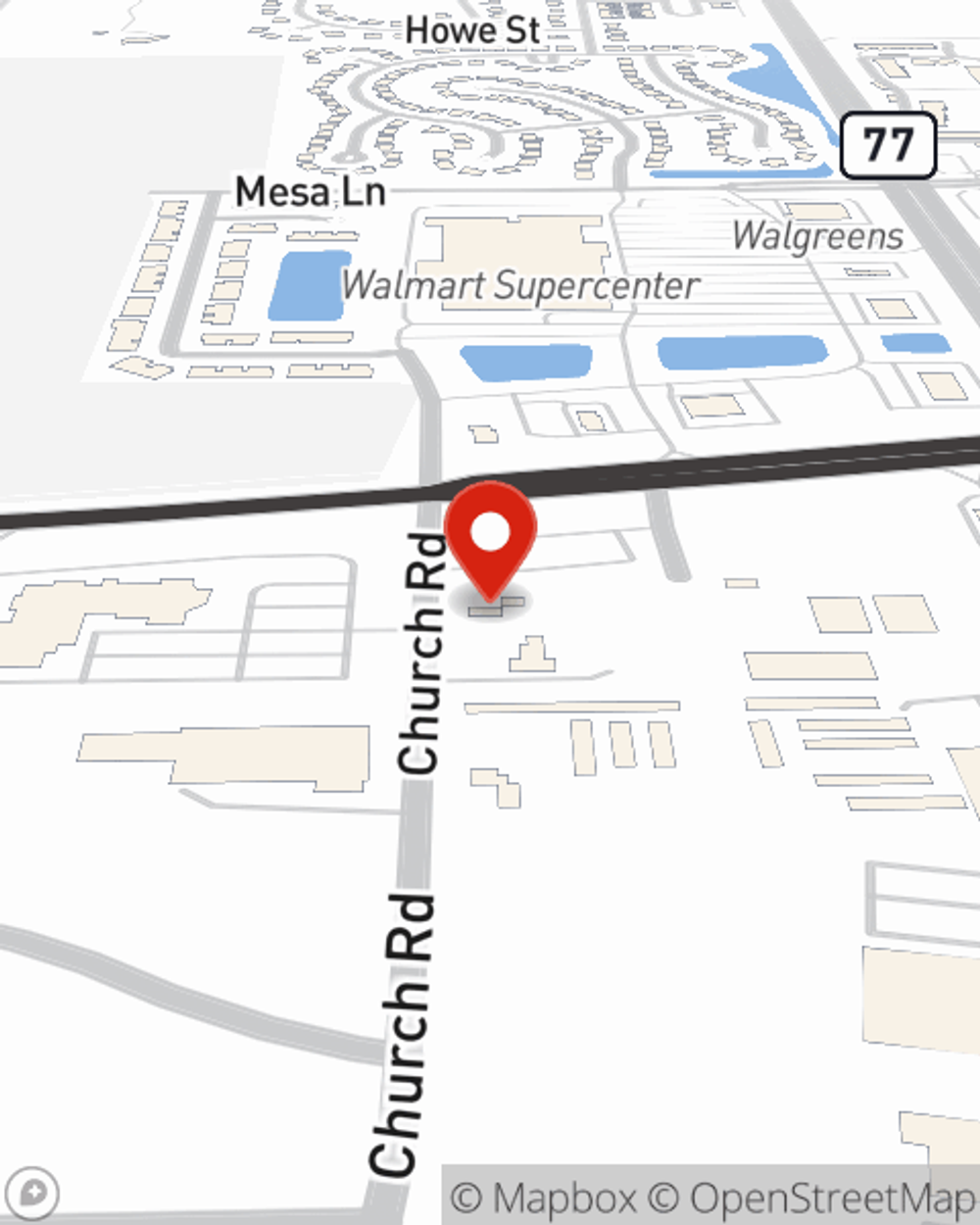

Ryan VanderVeen

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.